What Is Term Life Insurance?

What you need to know about…

Term Life Insurance

Term life insurance is extremely affordable and can be used to…

- Pay off debt

- Replace income

- Pay for funeral expenses

How does a term life insurance policy work?

Term life insurance lasts for a specified period of time and is very affordable. With most companies the options are 10, 15, 20, and 30 years.

At the end of the “term” you have the option to renew the policy or just let the coverage go away. Your price will be based on your age, health, and the length of time your term life insurance will cover.

Shorter term policies cost the least amount up front.

Does the price go up when I renew my term life insurance?

Yes. At the end of your term your life insurance coverage period the renewal rate will be based on your new age so there will be a higher premium.

With this in mind, many choose longer term policies with fewer rate increases. This allows them to save money over time.

Can I still renew my term life insurance if I become ill?

It depends on the life insurance company. Some companies do offer renewals without new evidence of insurability requirements.

Also, many companies offer a conversion privilege that will allow you to change your term life insurance policy into a permanent life insurance policy.

Are there any other benefits?

Yes! Our carriers offer a special benefit that can pay you cash if you suffered from a heart attack, stroke or even receive a cancer diagnosis while your policy is in force.

Do I need to take a medical exam?

No, an exam isn’t necessary to qualify.

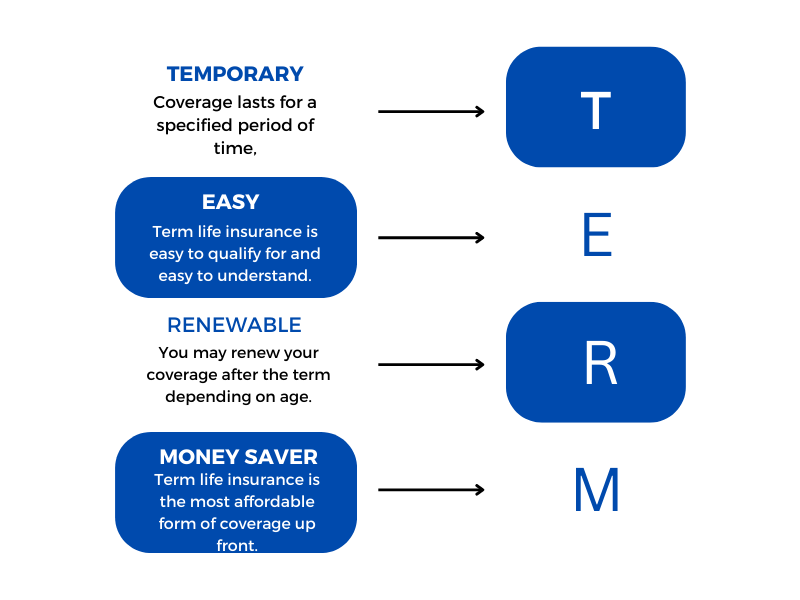

An easy way to remember how term life insurance works…

Here’s a real world example…

Kevin and Stacy

Recently married, Kevin and Stacy just purchased a home. The also got the great news that they are expecting a child.

As they begin the plan for their new edition they become concerned about how the other would fare financially without their income.

So many questions came to mind like could they afford the home, would they be able to afford college, would their quality of life diminish and so many other things.

This is when they began looking into protecting each other with term life insurance. They found the premiums to be affordable for their growing family and it gave them piece of mind.

They went with a 30-year term life insurance plan because that was long enough to cover their mortgage paying period as well as to be sure their child would be an adult before the term life coverage ended.

They also liked that by the time their term life insurance would expire they would be at retirement age.

They will also have the option to convert their policy to permanent life insurance if they want to leave a tax-free inheritance through a life insurance policy no matter how long they may live.

Sample term life insurance pricing for 30-year term on a healthy, non-smoking 30yr old male without an exam

*Medical exam is optional. Favorable exam results may qualify for a lower premium amount.

- $38/mo

- $71/mo

Check out our newsletter

Our promise to you…

Here at A.L. Johnson Life Insurance Agency we pride ourselves in providing excellent service to our clients.

Need immediate assistance? Call us at 913-279-1463. You may also use the contact form below.